Economic policy can no longer ignore the macroeconomic impacts of Australia’s superannuation system and the emerging policy implications.

There is a lamentable consensus that the transmission mechanism of monetary policy works predominately via the 30 per cent of Australian households with mortgage debt. Consequently, much of what passes for economic discourse too often reverts to discussions around the impact of interest rate changes on this minority of Australian households.

Yet there are other policy decisions that are equally as important in influencing the economic outlook which impact virtually all households and receives scant comment and certainly doesn’t appear to enter the thoughts and discussions of our central bankers.

In this note, we isolate the impact of lifting the Superannuation Guarantee (SG) levy and superannuation wealth has upon economic growth and we compare those impacts to interest rate hikes and the Stage 3 tax cuts.

In short, the Reserve Bank of Australia (RBA) can no longer think in terms of managing domestic policy relative to the actions of major foreign central banks and domestic fiscal policy. There is now a third home grown force that is acting as an important influence upon the economic cycle which has positive long-term benefits, but ultimately may compound the need for a domestic easing cycle through 2024-25.

Australia’s unique superannuation system generates greater macro side-effects

Australia’s relationship with its retirement income system is unique in many respects but where Australia’s system really stands out relative to its global peers is that it is: (i) compulsory; and (ii) privately managed. Unlike most of Europe where government social insurance schemes tend to be unfunded and which do not quarantine the funds from other government funds, the Australian system is inherently more stable.

Four key reasons underpin this stability:

1. It shifts the investment risk on to the individual.

2. It is transparent.

3. It is professionally run.

4. It has reached critical mass.

It may not be perfect, but Australian superannuation will provide a meaningful contribution to retirement income over and above the aged pension. Yet it is the compulsory nature of Australia’s superannuation, held in trust on behalf of the individual and at arm’s length from public sector policy makers that makes the Australian system far more likely to create externalities and distortions as the system matures. That is, a lift in an individual’s

superannuation wealth is more likely to be viewed as a permanent shift in wealth in Australia compared to the US or Europe.

There has been heightened focus in recent years on how adequate, how equitable, how sustainable and how cohesive the superannuation system is and how the industry might need to change in the future to improve those aims. Indeed, the Retirement Income Review of 2020 provided an excellent foundation for policy makers and industry participants to tweak the system for more optimal outcomes.

Yet there has been less focus on some of the broader impacts of the current system on important macro economy variables and how they interact with monetary policy.

Superannuation savings and the consumer

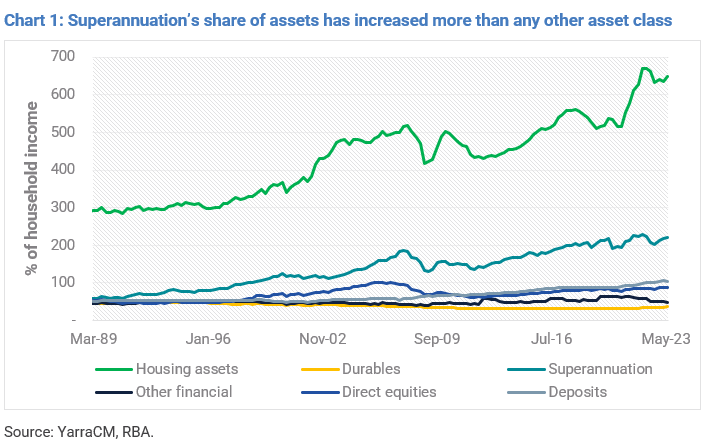

The RBA has had numerous attempts at modelling household consumption and components of wealth over the years. While it is easy to find a strong relationship between consumption and income over time, attempts to model national consumption relative to different types of wealth has largely proven elusive. In particular, despite superannuation’s 23 per cent share of net household wealth, attempts to isolate the importance of superannuation as a driver of consumption have been inconclusive at best.

Massive fiscal transfers to the household sector during the COVID-19 period, surging inflation and largely unrealised fears of a housing price correction have meant there have been other larger forces buffeting consumption in recent times. However, as Australia embarks on its last great push towards a 12 per cent SG levy simultaneous with large higher income tax cuts, some important questions need to be asked and answered.

In particular:

- Do superannuation wealth changes actually matter for near term consumption?

- How does the propensity to consume out of wealth accumulation in superannuation differ from other forms of financial wealth and housing wealth?

- How much does shifting up the SG levy by 1 per cent impact consumption and how does this compare to the size of the scheduled income tax cuts scheduled for mid-2024?

- How will all of this be interpreted by the RBA?

Traditional consumption models are poorly designed to answer these types of questions. Even the larger economy-wide models favoured by policy makers will fail to deliver the appropriate answers if the consumption function is incorrectly specified in the first place. There is also the added problem that Australia’s recent inflation spike is yet to be resolved and a large bank of un-utilised savings built up in the post-COVID period still looms large over the outlook for consumption growth.

Faced with these challenges, we find that it is better to approach the task from a different angle. Given we are really interested in the impact of superannuation on household saving behaviour it is best to attack the problem directly and model consumption as a ratio of income rather than the more common approach of consumption as a ratio of a consumer price level.

In other words, we are directly modelling the inverse of the household saving ratio and, in doing so, we do not need to be concerned about historical or future consumer prices . This eliminates the issue of having a firm view on inflation dynamics when we come to thinking about forecasting, which in the current environment is a blessing.

Secondly, we have the option to use a more meaningful measure of income. By adjusting for income tax paid and interest receipts and payments we can directly assess the impact of tax changes on household savings and spending. We can also isolate the impact of interest rate changes on the decision to spend today or save for tomorrow.

Key insights from the model

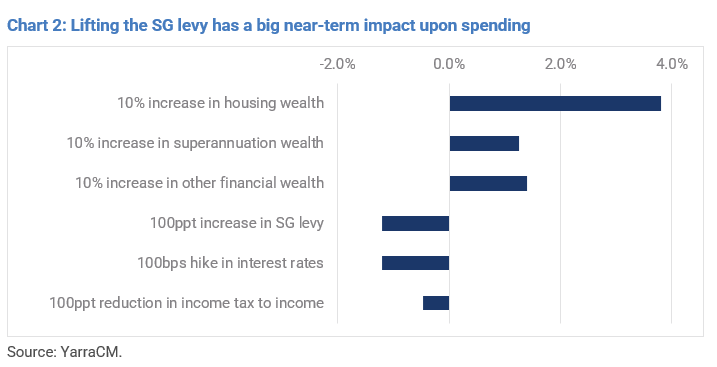

The highlight from the model is that we find a strong relationship between the way the consumer responds to shifts in both superannuation wealth and to shifts in the SG levy. We find that shifts in superannuation wealth do influence near term consumption decisions.

Despite most people not being able to access their superannuation assets until post-retirement, a 10 per cent increase in superannuation assets results in the household saving rate declining by 1.4 per cent which equates to $1,500 p.a. extra consumption per household.

Not surprisingly, housing wealth has a bigger influence over consumption spending. In fact, it’s almost three times larger. The model finds that if house prices rose by 10 per cent and that rise was perceived to be permanent, then household saving ratio could be expected to decline by 3.8 per cent. This represents a boost of $4,800 to consumption per household.

Interestingly, non-housing and non-superannuation wealth has only a slightly larger influence on saving and consumption as superannuation wealth. Thus, despite the ability to access this form of wealth without restriction movements in this form of wealth are seemingly either viewed by the consumer as less permanent or this wealth is concentrated in wealthier households which have a lower propensity to consume.

While it is satisfying to have found a way to isolate the wealth effect on consumption from superannuation, perhaps the most important finding in the model is that a movement in the SG levy has large and immediate impacts upon saving and consumption behaviour.

In particular, we find that a rise in the SG levy from 9 per cent in 2014 to 11 per cent from July 2023 has raised the saving ratio permanently by 2.4 per cent. This will rise to 3.6 per cent from July 2025 as the SG levy rises to 12 per cent.

To reiterate, the compulsory and trusted nature of the Australian superannuation system facilitates a structural rise in the saving ratio. Yet, this comes at a cost to current consumption, particularly for those households with lower income and younger households.

From June 2022 to July 2024 the SG levy will have increased by 1.5 per cent. To put this in context, our modelling finds a 100bps increase in interest rates increases the saving rate by 1.2 per cent and a 100ppt in crease in the SG levy also increases the saving rate by 1.2 per cent.

In other words, the rise in the SG levy from 10 per cent in June 2022 to 11 per cent in July 2023 is equivalent to four RBA rate hikes of 25bps. The rise in the SG levy on 1 July 2024 to 11.5 per cent will equate to two further 25bp rate hikes. The same dose will be repeated from July 2025 when the SG levy reaches its terminal rate of 12 per cent.

Since May 2022 the RBA has increased interest rates by 425bps, and while this is heavily impacting indebted households, the rise in term deposit (TD) rates has provided a mitigating impact. Although savers have welcomed attractive TD rates in recent months, the reality is that deposit rates have not kept pace with rising mortgage rates.

This means that for the aggregate consumer, the signal to save verses consume has been diminished. If the RBA wants a slower economy without crushing the bottom half of the income distribution, in our view, it should insist that TD rates keep pace with cash rate rises.

The important point is that a shift in the SG levy by 100bps is just as important a 100ppts interest rate rise. Yet when TD rates don’t keep pace with mortgage rates, a shift in the SG levy by 100bps will greatly exceed the impact of a 100bp increase in the cash rate. In our view, this partly explains why luxury consumption has been largely unimpacted by interest rate hikes to date.

Tax cuts and policy implications

What about the Stage 3 income tax cuts scheduled for July 2024? The tax cut is equivalent to 1.1 per cent of disposable income. Our model suggests that when a tax cut is delivered, approximately half is typically saved. In this case, the tax cut skews to higher income households and arguably an even greater share will be saved. The much-discussed generosity of planned income tax cuts will only return the tax to income ratio to where it was

18 months ago!

In the current ‘higher for longer’ mindset for interest rates, perhaps the most important influence over the outlook for the consumer is something that is far less newsworthy as movements in house prices, equities and bonds and certainly less newsworthy as the politics of an income tax cut. The most direct force in the Australian economy of shifting down the consumption share of the economy and subduing near term spending will be the

SG levy.

While this is no bad thing for an economy that currently has too much inflation heat, we seriously doubt that policy makers are looking at the 1 per cent lift in the SG levy from June 2023 to July 2024 as equivalent to a further four RBA rate hikes!

Should the economy cool more than the RBA expects through 1H24, the lift in the SG levy may well spark the need for a more aggressive easing cycle in 2024-25. It will also be interesting to see whether the government attempts to offset the enforced private sector saving via some new fiscal stimulus with an eye to the polls and the next federal election.

Tim Toohey is head of macro and strategy at Yarra Capital Management.