FY19’s close brings an ordinary year of returns to an end

The superannuation sector met industry analysts’ expectations for FY19, delivering returns in the positives but slightly below average for the last decade, with MySuper options generally offering members solid performances of five to six per cent and there being little difference between growth and aggressive options, data from FE Analytics has revealed.

The ASP Balanced sector, which includes most MySuper options offered by super funds, returned 5.77 per cent for the financial year, which was down on previous years. As has been much discussed within the industry however, the last decade has delivered consistently above average returns for superannuation funds as the share market rode high after recovering from the Global Financial Crisis. As such, while 5.77 per cent is less than members saw in their returns over previous financial years, it’s still a solid result for what was an inconsistent year in investments and maintains the superannuation industry’s reputation for consistently positive returns each financial year.

Within the sector, Australian Ethical’s Balanced Accumulation option was the best performer, with returns of 10.32 per cent for the financial year at the trade-off of having volatility above the sector average at 6.52 per cent. It achieved these returns by looking beyond the Australian market, holding around a quarter of its funds under management in international equities and slightly less than that in global fixed interest assets. Approximately a third of its investments were in Asia Pacific equities.

Suncorp’s Corporate Investment Super Balanced option was the next best balanced sector performer for FY19, with returns of 9.92 per cent, followed by QSuper’s Balanced option and CareSuper’s Sustainable Balanced option with 9.74 and 9.49 per cent respectively. Suncorp Super rounded out the top five performers, with its Bond Balanced and Lifesaver Balanced options delivering the same return of 9.14 per cent.

It was a slightly more unstable year for the Balanced sector than it was used to, recording volatility of 5.09 per cent as opposed to 3.70 and 4.20 per cent over the last three and five years to 30 June respectively, but that’s unsurprising when December’s shock stock market slump is taken into account.

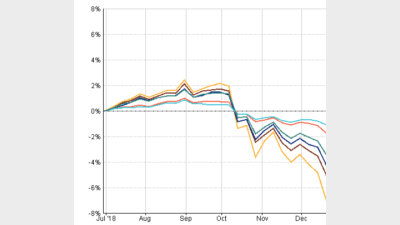

Looking to super options focused on higher returns, there was little difference between options in the ASP Mixed Asset – Aggressive and Growth sectors, as the chart below shows. The two sectors returned 6.52 and 6.43 per cent for FY19 respectively. The volatility of each sector over the same period was more substantial, however – the Aggressive sector recorded 8.69 per cent in the metric as opposed to 6.95 per cent for Growth – so perhaps the heightened risk of aggressive settings isn’t worth it for some members considering the much closer returns.

FY19 of sectors in the superannuation universe

Source: FE Analytics

Of course, the nature of superannuation means that a longer-term outlook also warrants consideration. While the Aggressive sector outstripped its Growth counterpart over the three and five years to 30 June by closer to one percentage point though, over ten years it was again just 0.11 points different.

Finally, at the end of the superannuation spectrum more focused on those in or approaching retirement, the ASP Mixed Asset – Moderate and Cautious sectors both returned predictably conservative performance for FY19 with returns of 4.67 and 4.13 per cent and volatilities of 2.98 and 2.26 per cent respectively.

These were in-line or above with their performances over the last decade. In fact, unlike the other sectors, Moderate and Cautious options largely outperformed their three and five-year averages this financial year. The reason for this is predictable; as conservative investment options, they were protected against FY19’s second quarter downturn in a way that more growth-focused portfolios were not.

Recommended for you

Super trustees need to be prepared for the potential that the AI rise could cause billions of assets to shift in superannuation, according to an academic from the University of Technology Sydney.

AMP’s superannuation business has returned to outflows in the third quarter of 2025 after reporting its first positive cash flow since 2017 last quarter.

The major changes to the proposed $3 million super tax legislation have been welcomed across the superannuation industry.

In holding the cash rate steady in September, the RBA has judged that policy remains restrictive even as housing and credit growth gather pace.