Use revenue from $3m cap to close gender gap: ASFA

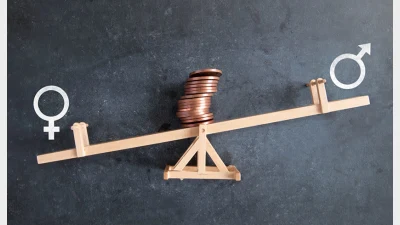

The Association of Superannuation Funds of Australia (ASFA) is calling on the Government to close the retirement savings gender gap by using tax revenue from the proposed $3m super cap.

Last week, it was announced the Government was seeking to double the concessional tax rate for super balances exceeding $3 million from 15% to 30%. The revised rate would apply to future earnings from July 2025.

ASFA senior policy adviser, Helena Gibson, said the Government should use this extra money to help to close the gender gap. Currently, Australian women retired with an average of 23% less super than men.

Women aged 55-59 years old exhibited the largest difference between super balances, with a gap of $44,400 (or 30%) between men and women while those aged 60-64 years old had a difference of $41,200, according to data from Morningstar.

“ASFA is calling for long overdue action to protect the retirement outcomes of women who take time out of the workforce, two simple measures – SG (Superannuation Guarantee) on Paid Parental Leave, and a Super Baby Bonus of $5,000 would eliminate the gender retirement savings gap by 2050.”

ASFA modelling found the cost of paying SG on Paid Parental Leave would be $200 million.

"There is strong support among Australians for policy action. Results of a recent ASFA survey show that more than 80% of people agree that Government should try to boost the super balances of women who take time out of the workforce to have children.”

Recommended for you

While the Liberal senator has accused super funds of locking everyday Australians out of the housing market, industry advocates say the Coalition’s policy would only push home ownership further out of reach.

Australia’s largest superannuation fund has confirmed all members who had funds stolen during the recent cyber fraud crime have been reimbursed.

As institutional investors grapple with shifting sentiment towards US equities and fresh uncertainty surrounding tariffs, Australia’s Aware Super is sticking to a disciplined, diversified playbook.

Market volatility continued to weigh on fund returns last month, with persistent uncertainty making it difficult to pinpoint how returns will fare in April.